Additional Info

Assumptions [pertinent but not exhaustive]

- The inputs of spot price, risk-free rate, strike price, and time to maturity are known with high confidence

- The large assumption: our estimate of volatility is correct and does not vary over the life of the contract

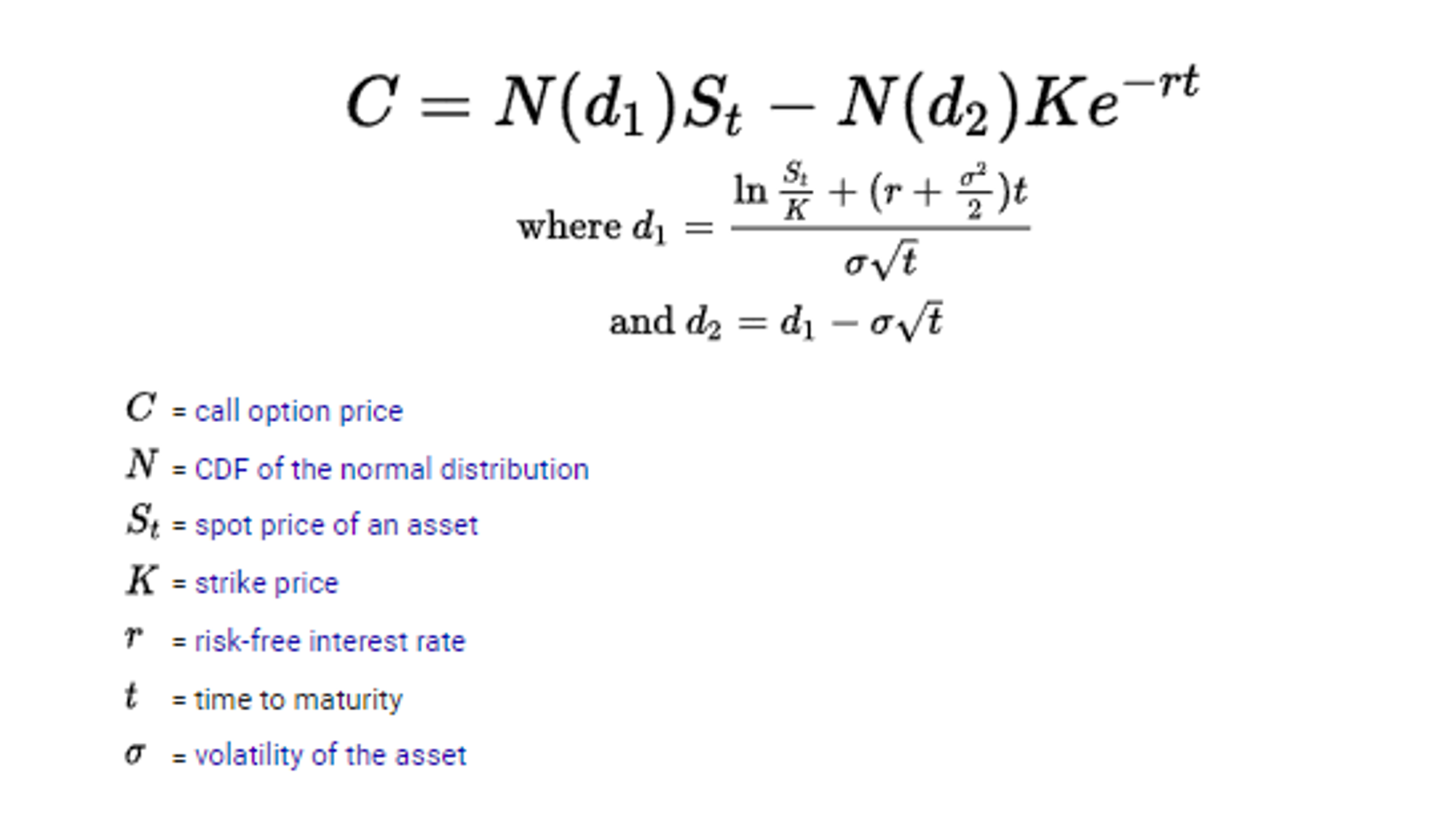

Definitions

- N(d1) = delta or hedge ratio of the option

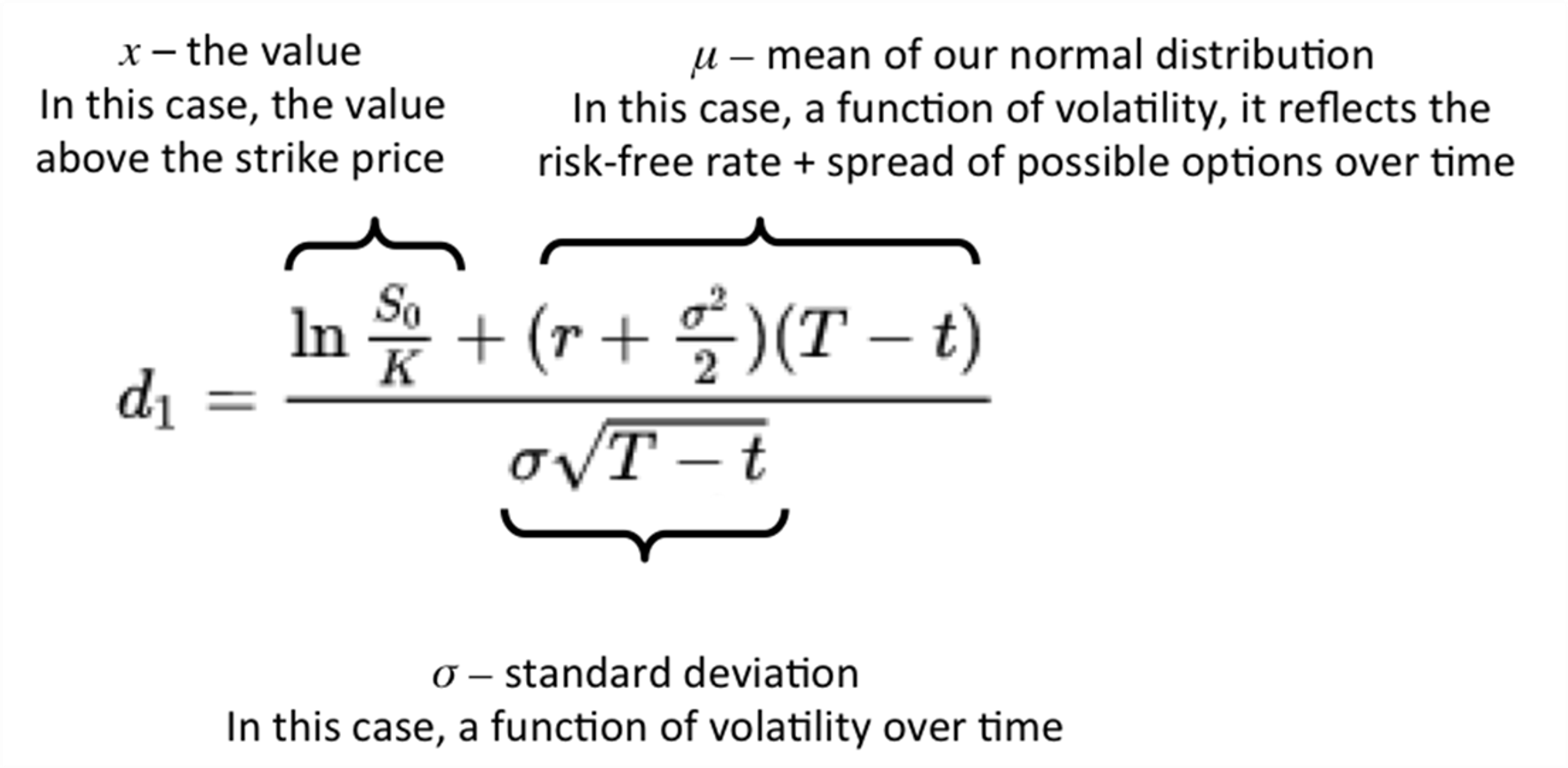

- If you look closely at d1 you will see that is the equivalent of a z-score:

- The numerator is the distance of the stock price from the strike

- The denominator normalizes that distance by vol time

credit: brilliant.org

- N(d2) = probability of the option expiring in-the-money

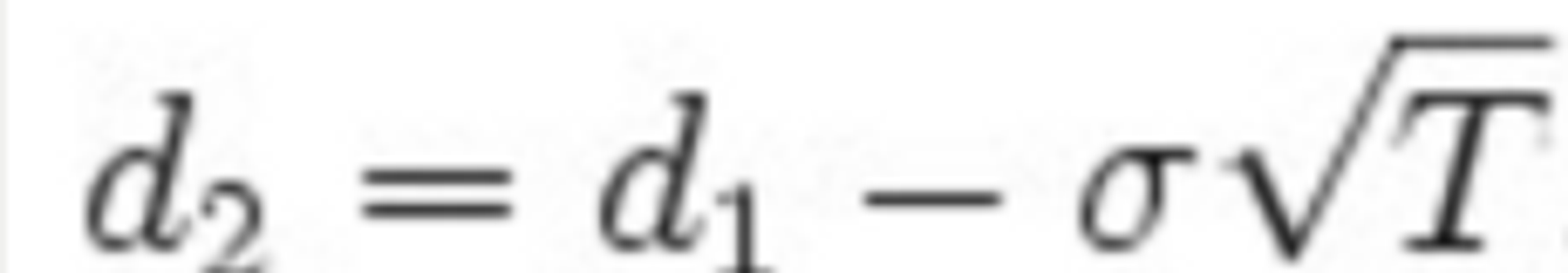

d2 is also a z-score but look closely —it is always less than d1

This means:

Delta is always greater than the probability of expiring in the money because delta is a hedge ratio. As a hedge ratio, it must account not just for probability but payoff.

If you have high volatility or lots of time to expiry, the right tail of a lognormal distribution is longer. So the number of shares you need to hedge the potential unbounded price of the call is larger

This means the divergence between d1 and d2 depends strictly on volatility and time to maturity.

Learn more