No-arbitrage probabilities allow us to price options by replication

The insight embedded in Black-Scholes is that, under a certain set of assumptions, the fair price of an option must be the cost of replicating its payoff under many scenarios. Any other price offers the opportunity for a risk-free profit.

Have you ever wondered why the Black Scholes “drift” term for a stock is the risk-free rate and not an equity risk premium (like you’d expect from another type of pricing model ie CAPM) or the stock’s WACC?

A position in a derivative and an opposing position in its replication is a riskless portfolio. Therefore that portfolio only needs to be discounted by the risk-free rate. Option pricing derived from a no-arbitrage replication strategy means we should use the risk-free rate to model a stock’s return.

What seasoned option traders get wrong

Outside of the option pricing context, the risk-free rate is the wrong assumption for drift!

One of the most common mistakes that even highly experienced practitioners make is to act as if the assumptions of Black-Scholes (lognormal, continuous distribution of returns, no transactions costs, etc.) mean that we can always arbitrarily assume the underlying grows at the riskfree rate r instead of a subjective guess as to its real drift μ. But this is not quite accurate. The insight from the Black-Scholes PDE is that the price of a hedged derivative does not depend on the drift of the underlying. The price of an unhedged derivative, for example, a naked long call, most certainly does depend on the drift of the underlying. Let's say you are naked long an at-the-money one-year call on Apple, and you will never hedge. And suppose Apple has very low volatility. Then the only way you will profit is if Apple's drift is positive; suppose Apple has very low volatility. Then the only way you will profit is if Apple's drift is positive…if it drifts down, your option expires worthless. But if you hedge the option with Apple shares, then you no longer care what the drift is. You only make money on a long option if volatility is higher than the initial price of the option predicted. The drift term of the underlying only disappears when your net delta is zero. In other words, an unhedged option cannot be priced with no-arbitrage methods

Takeaway: Arbitrage Pricing Theory

Sometimes called the Law of One Price, the idea contends that the fair price of a derivative must be equal to the cost of replicating its cash flows. If the derivative and cost to replicate are different then there is free money by shorting one and buying the other.

This approach is how arbitrageurs and market-makers price a wide range of financial derivatives in every asset class including:

- Futures/Forwards

- Options

- ETFs and Indexes These derivatives are the legos from which more exotic derivatives are constructed.

A Source of Opportunity

Let’s recap the logic:

- Arbitrage ensures that the price of a derivative trades in line with the cost to replicate it.

- A master portfolio comprising:

- a position in a derivative

- an offsetting position in its replicating portfolio

This master portfolio is riskless.

- A riskless portfolio will be discounted to present value by a risk-free rate otherwise there is free money to be made.

- The prevailing prices of derivatives imply probabilities.

- Those probabilities are risk-neutral arbitrage-free probabilities.

But those probabilities don’t need to reflect real-world probabilities. They are simply an artifact of a riskless arbitrage if it exists.

This can lead to a difference in opinion where the arbitrageur and the speculator are happy to trade with each other.

- The arbitrageur likely has a short time horizon, bounded by the nature of the riskless arbitrage.

- The speculator, while not engaging in an arbitrage, believes they are being overpaid to warehouse risk.

Examples

1) Warren Buffet selling puts

The Oracle of Omaha engages in oracular activity — not arbitrage. Warren is well-known for his insurance businesses which earn a return by underwriting various actuarial risks. Warren is less famous for his derivatives trades.

[The fact that he rails against derivatives as WMDs might be the most ironic hypocrisy in all of high finance but, ummwe are multitudes.]

Like his insurance business, the put-selling strategy hinges on an assessment of actuarial probabilities. In other words, he believes that real-world probabilities suggest a vastly different value for the puts than risk-neutral probabilities.

The major source of the discrepancy comes from the drift term in Black Scholes. Warren is pricing his trade with an equity risk premium in excess of the risk-free rate that a replicator who delta hedges would use.

The option traders who trade against him can be right by hedging the option effectively replicating an offsetting option position at a better price than the one they trade with Berkshire. Warren is happy because he thinks the price of the option is “absurd”.

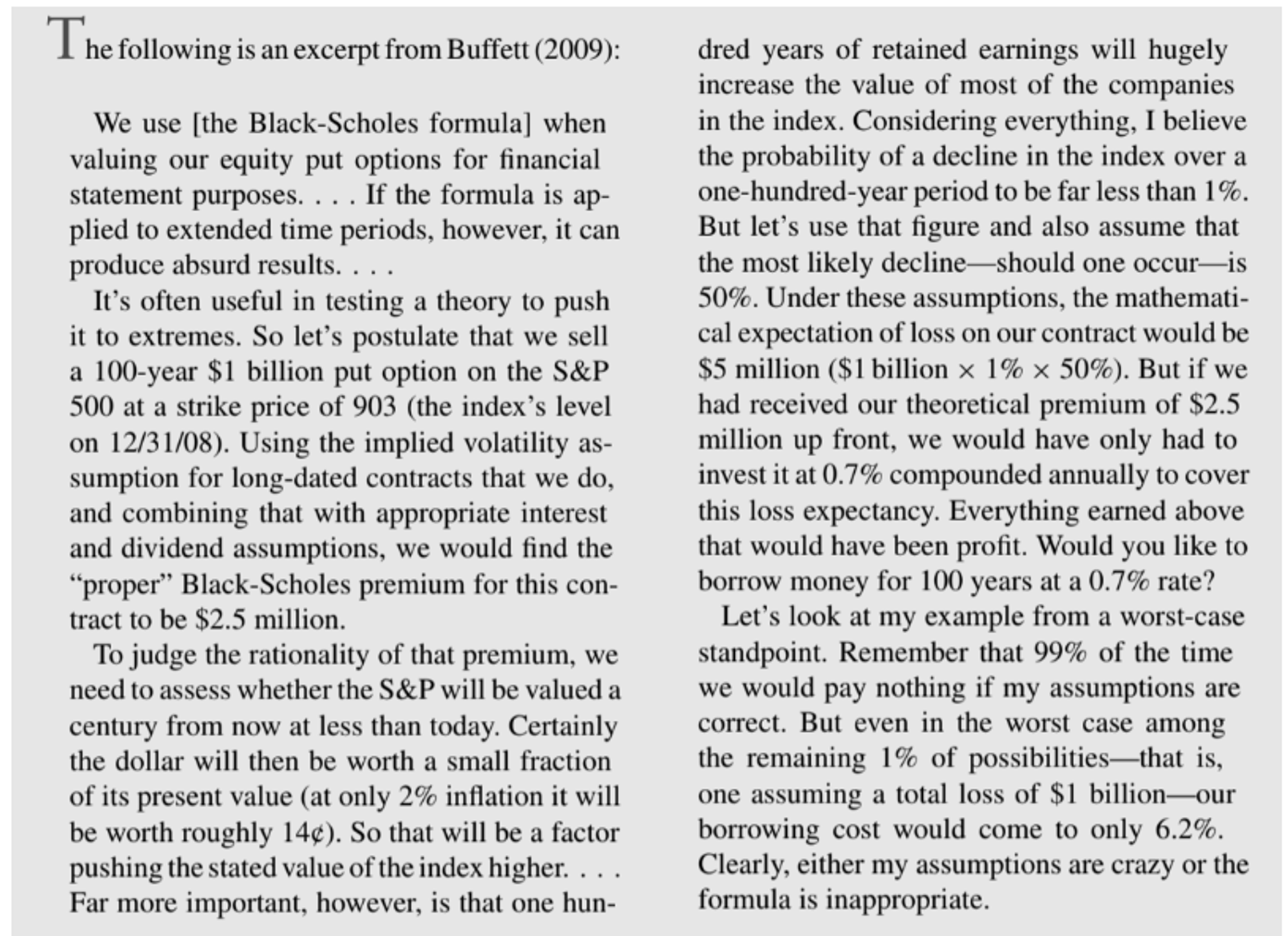

In Warren Buffett is Wrong About Options, we see this excerpt from a Berkshire letter during the GFC:

Jon Seed writes:

Warren’s assumptions aren’t crazy. In fact, they seem to be pretty accurate. As Robert McDonald derives in the 22nd Chapter of his 3rd addition of Derivatives Markets, a 100 year put for $1bn assuming 20% volatility, a long-term risk free rate of 4.4% and a dividend rate of 1.5% implies a Black-Scholes put price of $2,412,997, close to Buffett’s $2.5 million. But Warren isn’t discussing risk-neutral probabilities, those assumed in Black-Scholes and imputed by volatility assumptions. He’s evaluating the model’s probabilities as if they were real, actual probabilities. If we, (really Robert McDonald), evaluates Black-Scholes using real probabilities by also incorporating our best guess of real equity discount rates, we see that the model is consistent with Warren’s common sense approach. Assuming stock prices are lognormally distributed and that the equity index risk premium is 4%, we would substitute 8.4% for the 4.4% risk-free rate, obtaining a probability of less than 1% that the market ends below where it started in 100 years. Buffett also assumes that the expected loss on the index, conditional on the index under-performing bonds, will be 50%. This again is a statement about the real world, not a risk-neutral world, distribution. With an 8.4% expected return on the market, the implied expectation of $1 billion of the index conditional on the market ending below where it started is $596,452,294, or 59.6% of the current index value. Again, this is close to Buffett’s assumption of 50%.

2) FX Carry

FX futures are derivatives. Their pricing is a straightforward output of the covered interest parity formula. I think I learned this concept on the first day of trader class back in the day.

The key to the formula is recognizing that the value of the future is just the arbitrage-free price arising from the difference in deposit rates between the 2 currencies in the pair.

If a foreign currency offers a higher interest rate than a domestic currency, you expect its future to trade at a discount. We won’t bother with the math since the intuition is sufficient:

If you borrowed the domestic currency today to buy the foreign currency so you could earn the yield spread for say 1 year, you’d have a risky trade — you’d be exposed to the foreign currency, and its associated interest income, devaluing when you try to convert it back to the domestic currency.

therefore, to make the trade riskless, you need to lock in the forward rate today by selling the future. You know what that means — you expect that forward rate to trade at the no-arbitrage price

The higher-yielding currency must therefore have a lower forward FX rate.

The carry trade is basically a speculator saying:

“I know the future FX rate should trade at a discount to the spot rate but I’ve noticed that the future rate rolls up to converge to the spot rate, rather than that lower rate being a predictor of the spot FX rate in one year.

So I’m going to buy that FX future and hold it for a profit.”

The carry trade is not an arbitrage or riskless profit. It’s a risky profit. But the opportunity arises because the futures contract would present an arbitrage at any price other than the risk-neutral price.