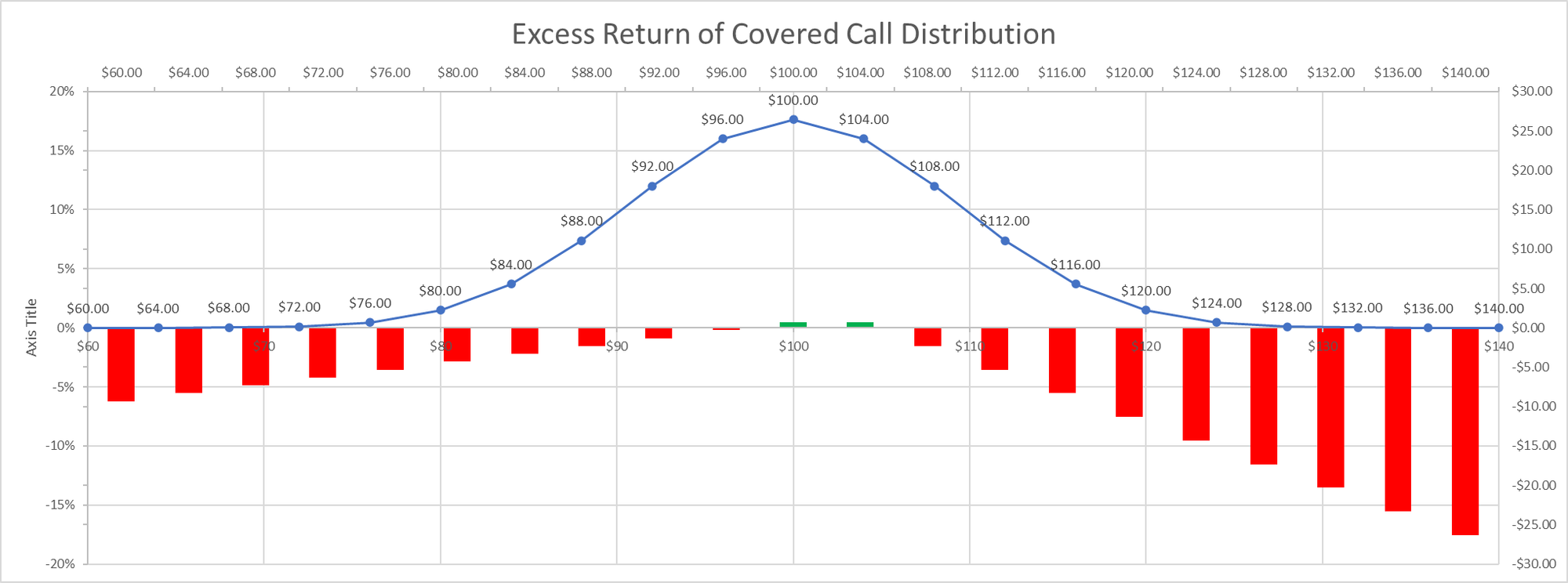

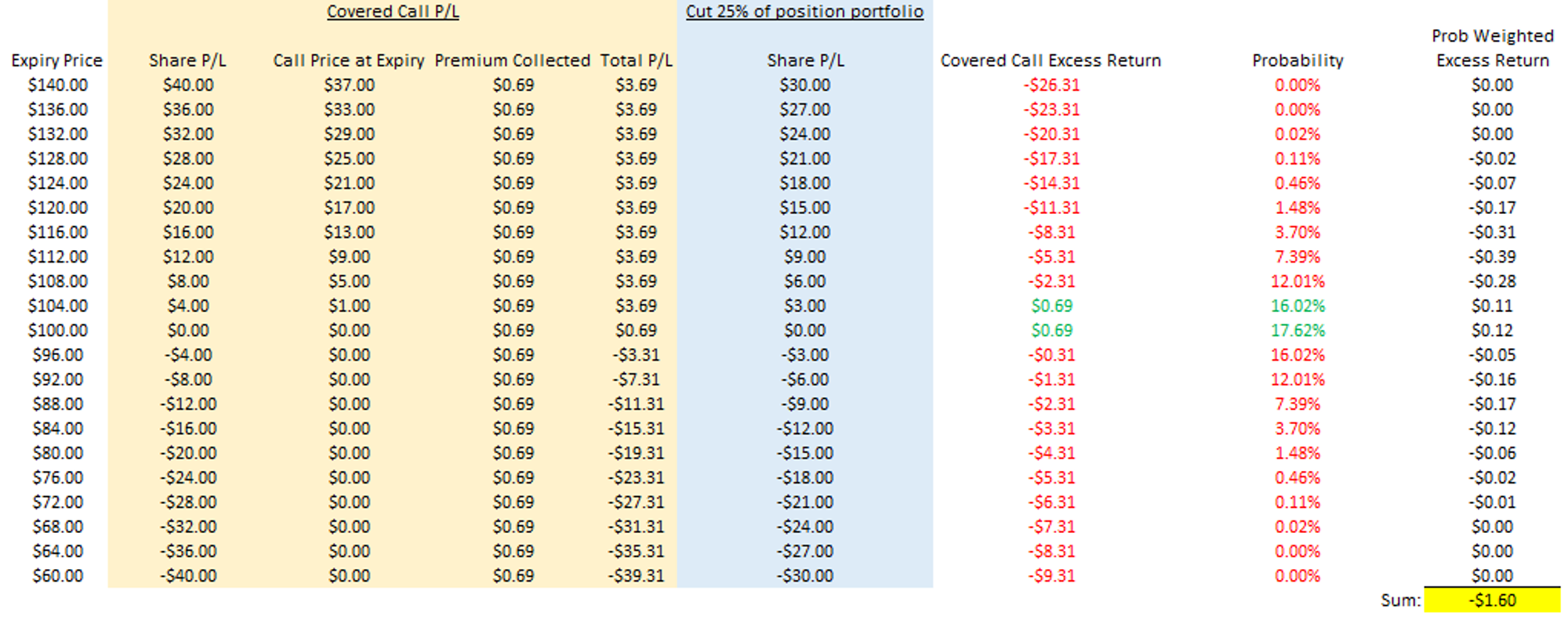

- Covered call outperforms ~34% of the time

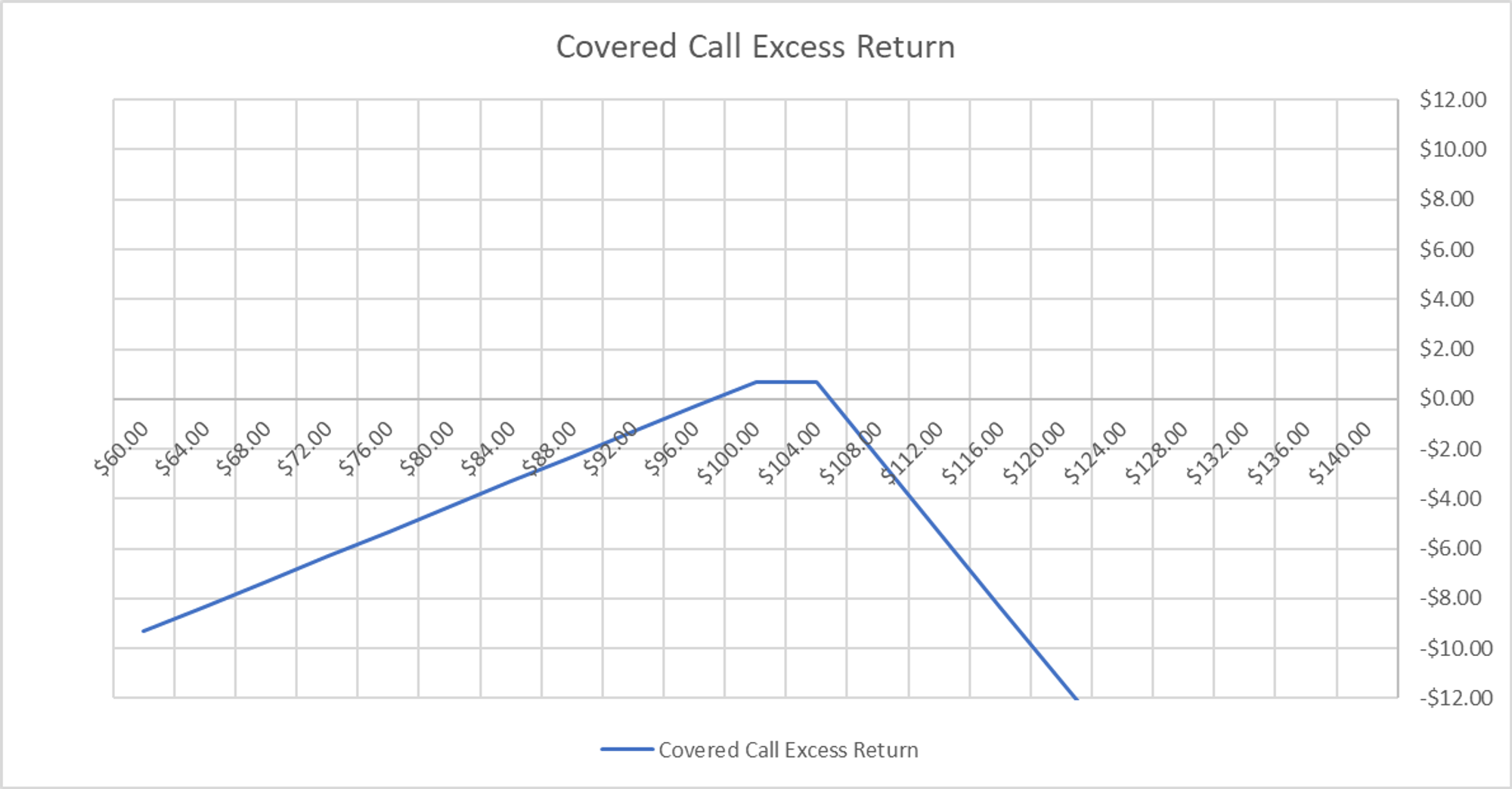

- You sold the 103 call at $.69…you expect to lose $1.60 of probability-weighted excess return since the stock moves $2.00 per day instead of $1

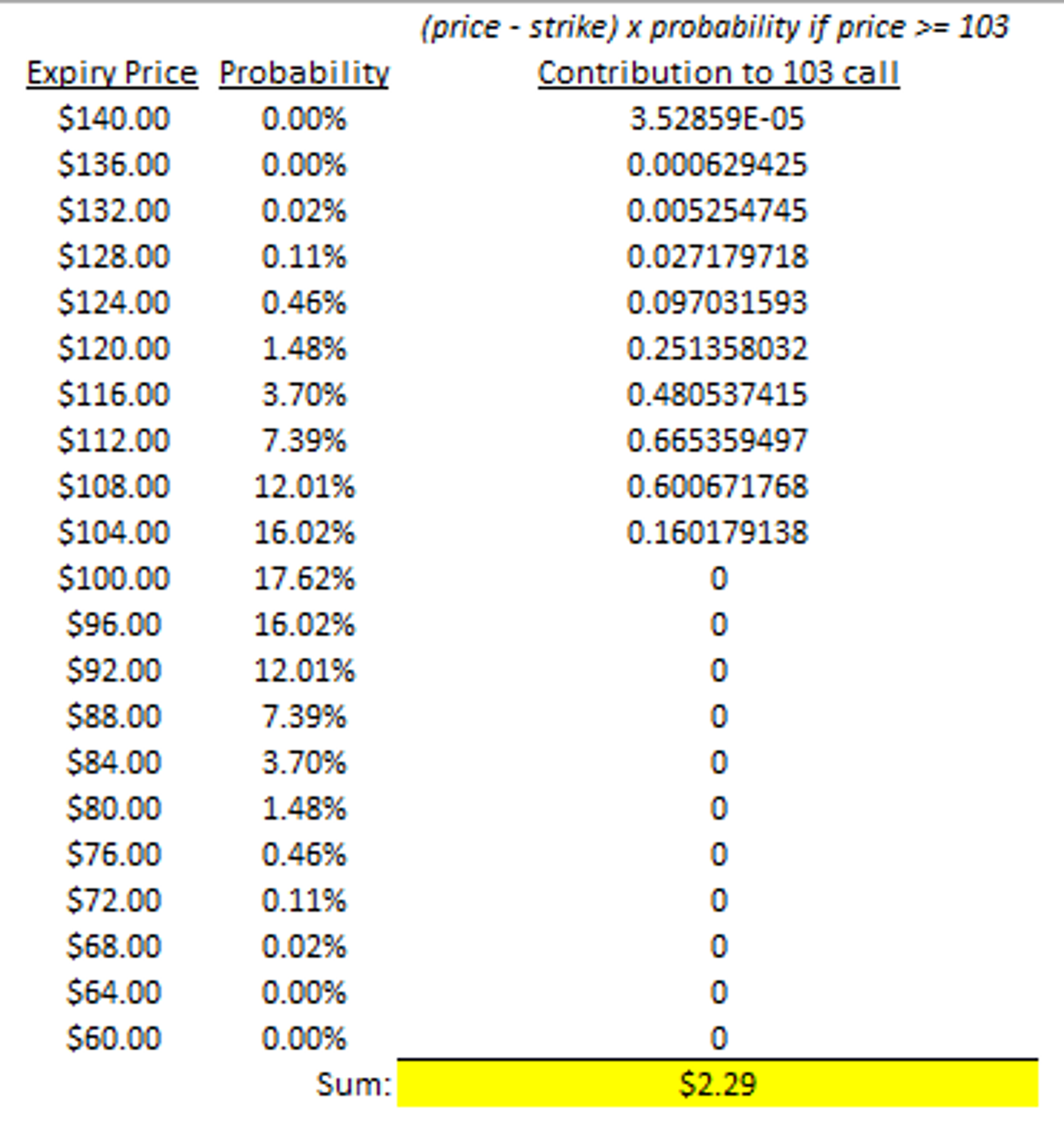

- This is confirmed by our binomial tree model where we compute option prices arithmetically. If the stock moves $2.00 per day the 103 call is worth $2.29