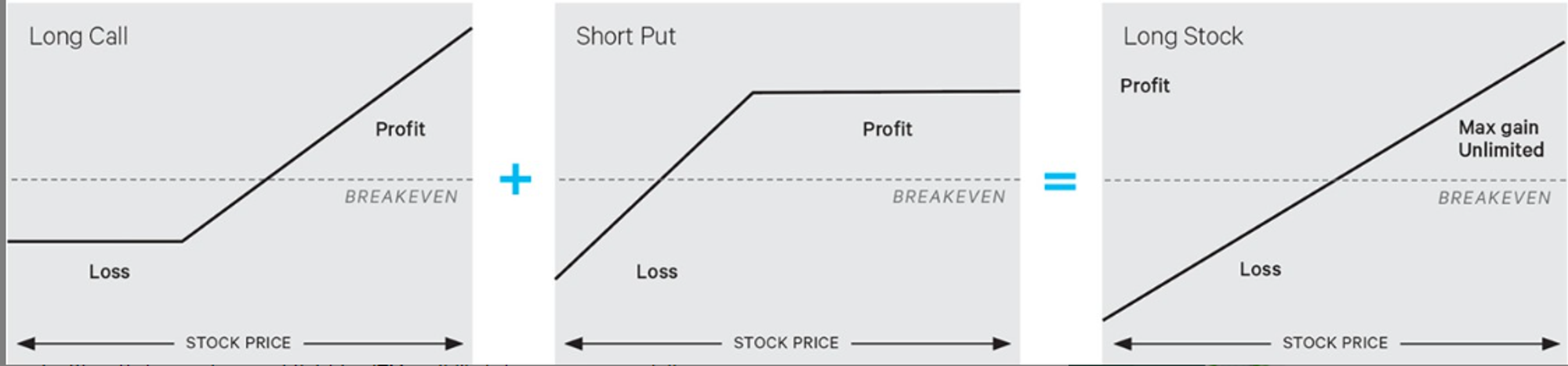

- Fundamentally, there is no difference between puts and calls, and this insight itself is not dependent on a particular model or restricted to only particular parameter values. It is a deep truth.

The big intuitive insight from put-call parity is that it doesn't matter whether you trade in puts or in calls: the two are in some deep sense identical, despite their surface differences. Optionality is the key. The kink is the key. Once you have a kink, you can go long or short and you can fiddle with forwards to make it go up or down or left or right as you see fit.

The simplest proof:

C - P = long stock (from hockey stick diagram)

[image credit: TD Ameritrade]

Therefore:

C = long stock + put